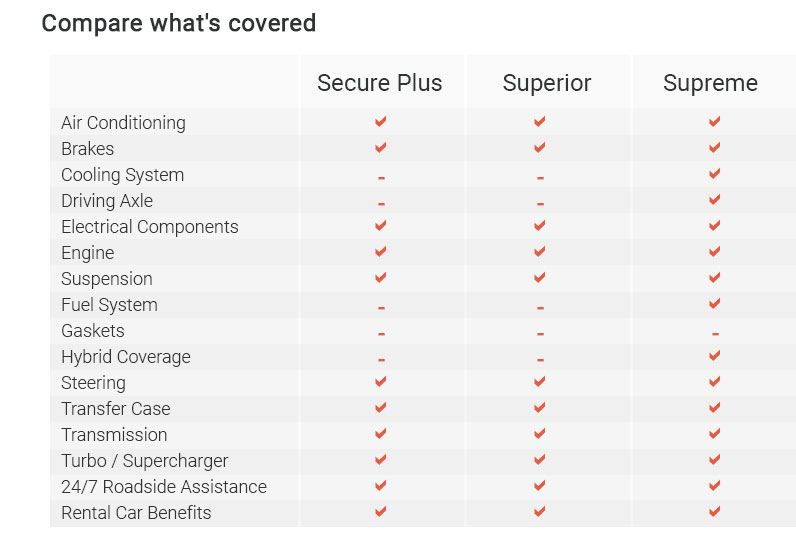

used vehicle warranty comparison guide for confident decisionsClear choices beat guesswork. A structured look at coverage, cost, and claims builds confidence and reduces risk. What coverage really meansNot all plans protect the same parts or to the same limits. Names can sound alike while obligations differ. - Powertrain: engine, transmission, drive components; often strong but narrow.

- Comprehensive/exclusionary: lists what's not covered; everything else is.

- Electronics and sensors: modern cars rely on them; verify modules and infotainment.

- Seals and gaskets: sometimes included only with specific tiers.

- Extras: roadside assistance, rental, trip interruption - handy, but check dollar caps.

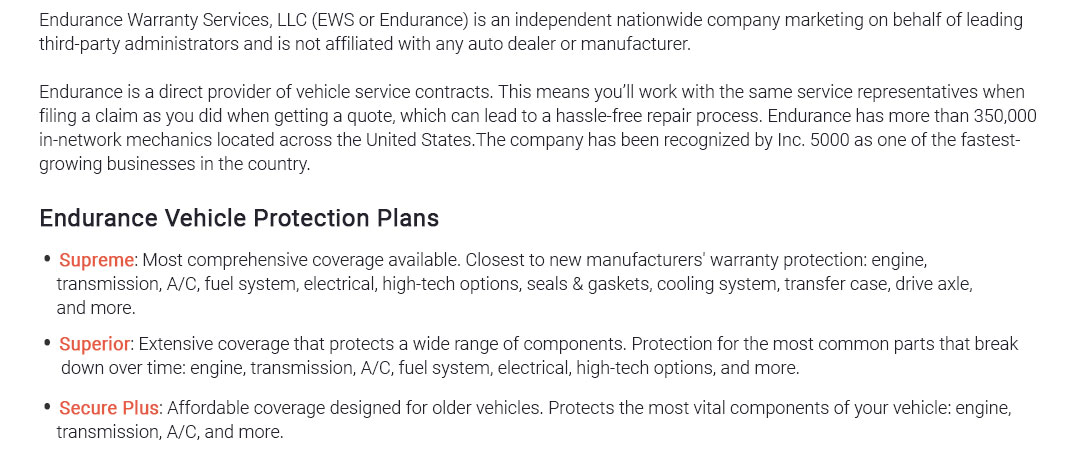

Common warranty types to compare- Manufacturer CPO: factory-backed, often easy claims at franchised dealers.

- Dealer service contract: convenient at purchase; terms vary by provider.

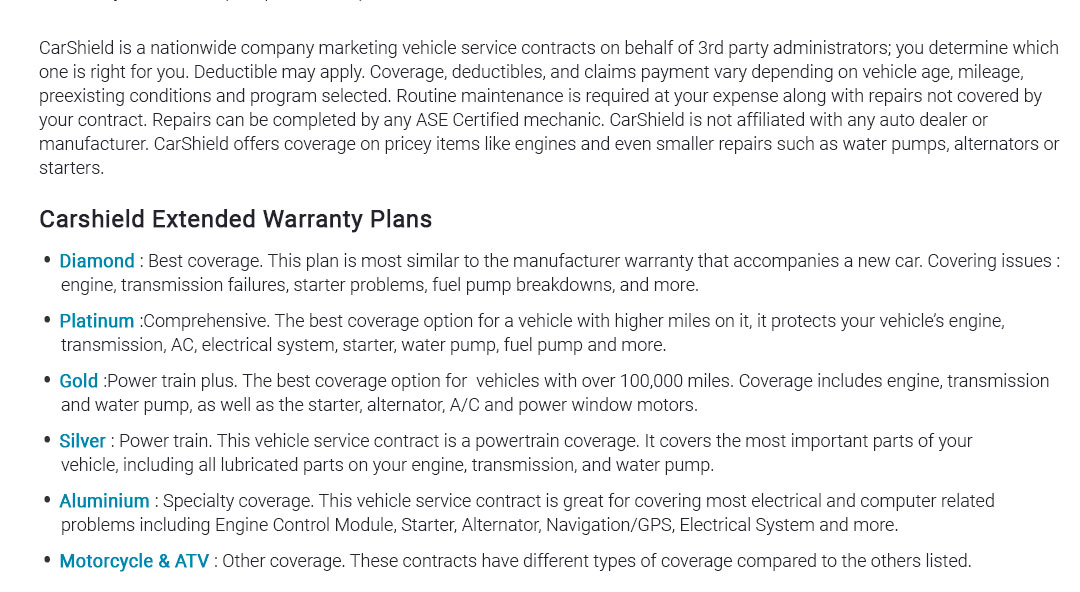

- Third-party administrator (VSC): broad networks; scrutinize underwriting strength.

- Limited powertrain add-ons: cheaper, focused protection; fewer ancillary perks.

Costs and value, in contextPrice alone misleads; what matters is paid repair performance over time. - Deductible model: per visit vs per repair item.

- Labor rate caps and parts pricing (OEM vs aftermarket).

- Surcharges for turbo, hybrid/EV systems, or luxury brands.

- Term and mileage overlap with your expected ownership window.

How to compare, step by step- Collect VIN, current mileage, and in-service date to standardize quotes.

- List high-risk systems for the specific model year (e.g., timing chain, infotainment).

- Request apples-to-apples terms: coverage tier, term/miles, deductible type.

- Read exclusions and claim limits; note per-claim and aggregate caps.

- Verify claims workflow: inspection rules, pre-authorization, payment method.

- Check cancellation and refund math; pro-rata vs short-rate.

- Confirm repair network: dealer, independent ASE shops, mobile options.

Small print that changes outcomesTwo plans can sound identical yet pay very differently. - Maintenance records required; gaps can jeopardize a claim.

- Preexisting conditions excluded; issues noted at inspection won't be covered later.

- Diagnostic time: covered or not, and at what hourly cap.

- Fluid, filters, and shop supplies - paid only when tied to a covered repair.

- Limits: "up to book value" or $5,000 per claim can cap large repairs.

A quick real-world momentAt a pre-purchase inspection bay, a shopper compared a dealer plan to a third-party quote on the phone. The factory-backed option cost a bit more, but it covered the touchscreen module flagged by the technician; the cheaper plan listed infotainment as an exclusion. Decision made in ten minutes, with paperwork saved for the glovebox. Signals of a solid plan- Sample contract available before payment; no surprises.

- Clear, plain-language coverage definitions with a short exclusion list.

- Direct payment to shops, not reimbursement only.

- 24/7 claims line and published average approval times.

- Backed by a well-rated insurer; administrators with a multi-year track record.

- Deductible that fits likely claim frequency; vanishing or $0 options if priced fairly.

Expectation check (pragmatic caveat)High-mileage vehicles, heavy modifications, or salvage titles may be ineligible or heavily surcharged, and corrosion or cosmetic wear is almost never covered. Claims typically require pre-authorization; skip that step and payment can be denied. Confidence, then resultUse a side-by-side list of coverage items, limits, deductible type, and claims steps. The confidence comes from knowing exactly how a repair gets approved; the result is fewer surprises, steadier costs, and a calmer ownership experience. If numbers run close, some shoppers choose basic powertrain coverage and keep a small repair fund for minor items - balanced, simple, effective.

|

|